Sunday, May 27, 2012

Sunday, May 20, 2012

Worst Case Scenario : Bull Market may have ended. 10-20% chance possible

I have formulated the Worst Case Scenario using EW Analysis, this is just a personal analysis and not a recommendation or whatsoever. In terms of Elliot Wave rules , I am not sure if I violated a rule which should be longer, shorter or which wave should be counted and not counted.

This may not be a valid count, or may not be, I just would like to share everyone that there could be others like me finding this count plausible. I am not sure, but I really DONT like this to happen. Just a sneak peak what usually happens after a Bull Market.

Might be 10-20% chance to happen. Feel free for other Elliot Waves traders to comment on this study.

Friday, May 18, 2012

Philippine Index Update 5-19-2012

Philippines is still tanking all the negative news all over the world. And I am still biased on its high valuation compared to other Asian Countries.

Based on Bloomberg, PSEi already fell from its overvaluation last 5300 (19 P/E), at current 4850, it is now at 16.5 P/E (but is still above the Asian 13-14x Average), a more comfortable level. Our GDP is not so high like China, but we are in an emerging country having sustainable growth YoY.

The 2011-2012 Rally of PSEi was enormous that makes me think that 50% and 61.8% retracement is highly probable and better for this economy.

50% retracement - 4500

61.8% retracement - 4688

These levels are still very far from the current 48xx, but is attainable once we see PSEi break below its possible Medium Term uptrend, based on charts attached.

People who bought last Thurs, has been whipsawed on Friday. I'm so happy that our Market is trading like a REAL MARKET,people getting whipsawed and not just the typical 5pt correction following a 50pt rally.

The Negative Divergence(MACD,RSI) formed since Feb2012-May2012 indicated a good result showing selloff/correction will follow after 5300 TOP. I hope people today are in CASH position after that hint, Negative Divergence usually hint a selloff may happen soon, so dont skip this "technical TIP" to stay safe. Usual Negative Divergence result to months-years timeframe, no one can forecast, just stay safe next time when Indicators show some weaknesses.

4500 PSEi is accommodating and my preferred support IF EVER, for now, be selective on your stock picks, and prefer 10x-15x valuation companies under Energy and Banks.

Waiting for DOW important 12250-12294 to hold, S&P 1292 to hold and rally, before starting to get into PSEi Market. Else, more selloffs may occur. Stay Safe!

Based on Bloomberg, PSEi already fell from its overvaluation last 5300 (19 P/E), at current 4850, it is now at 16.5 P/E (but is still above the Asian 13-14x Average), a more comfortable level. Our GDP is not so high like China, but we are in an emerging country having sustainable growth YoY.

The 2011-2012 Rally of PSEi was enormous that makes me think that 50% and 61.8% retracement is highly probable and better for this economy.

50% retracement - 4500

61.8% retracement - 4688

These levels are still very far from the current 48xx, but is attainable once we see PSEi break below its possible Medium Term uptrend, based on charts attached.

People who bought last Thurs, has been whipsawed on Friday. I'm so happy that our Market is trading like a REAL MARKET,people getting whipsawed and not just the typical 5pt correction following a 50pt rally.

The Negative Divergence(MACD,RSI) formed since Feb2012-May2012 indicated a good result showing selloff/correction will follow after 5300 TOP. I hope people today are in CASH position after that hint, Negative Divergence usually hint a selloff may happen soon, so dont skip this "technical TIP" to stay safe. Usual Negative Divergence result to months-years timeframe, no one can forecast, just stay safe next time when Indicators show some weaknesses.

4500 PSEi is accommodating and my preferred support IF EVER, for now, be selective on your stock picks, and prefer 10x-15x valuation companies under Energy and Banks.

Waiting for DOW important 12250-12294 to hold, S&P 1292 to hold and rally, before starting to get into PSEi Market. Else, more selloffs may occur. Stay Safe!

Facebook IPO: Price rarely got above its IPO Price on Day1 5-19-2012

Facebook successfully had its IPO Today in NASDAQ after few years of planning, millions and millions f user is increasing YoY, but the one and only question today about the IPO, is this a hype or a good investment IPO?

There are 2 types of person willing to BUY on this stock:

1. Dumb users who are hyped and using FB as a Daily social networking site. Which dont know much on Stock Valuation.

2. Hedge Fund Managers who know how to control stocks and have long term outlook on its income.

But hey, I am the 3rd type of person NOT willing to Buy this stock for a lots of reason:

1. Original IPO price is at 36 USD per share, in an overnight meeting, stock price was increased to 38 a piece. Boosting them extra Billions overnight.

2. FB needs to earn 1Billion Dollars a year, to make its 18Billion IPO value worth it. Assuming 18 P/E is a good valuation ratio.

3. Looking at todays trading, it even rarely got above 38 USD, When it went to almost 43 a piece, sellers seems to sell down even to the last 38.00 tick.

4. IPO day reflects the valuation of a stock, and todays trading shows it doesnt even go high.

5. The issuers of FB (Morgan Stanley and other institutions) are controlling the 1st day trading to hold aboove 38 mark, as it is their job to make sure it doesnt fall below by using Oversubscription powers/money, using Billions of Dollars to maintain the price, the question is, until when can they do it?

Many reasons NOT to buy, but many reasons to USE Facebook. For me, until FB shows clear direction how they can earn the 1B a year, until then that I will think twice buying this stock.

There are 2 types of person willing to BUY on this stock:

1. Dumb users who are hyped and using FB as a Daily social networking site. Which dont know much on Stock Valuation.

2. Hedge Fund Managers who know how to control stocks and have long term outlook on its income.

But hey, I am the 3rd type of person NOT willing to Buy this stock for a lots of reason:

1. Original IPO price is at 36 USD per share, in an overnight meeting, stock price was increased to 38 a piece. Boosting them extra Billions overnight.

2. FB needs to earn 1Billion Dollars a year, to make its 18Billion IPO value worth it. Assuming 18 P/E is a good valuation ratio.

3. Looking at todays trading, it even rarely got above 38 USD, When it went to almost 43 a piece, sellers seems to sell down even to the last 38.00 tick.

4. IPO day reflects the valuation of a stock, and todays trading shows it doesnt even go high.

5. The issuers of FB (Morgan Stanley and other institutions) are controlling the 1st day trading to hold aboove 38 mark, as it is their job to make sure it doesnt fall below by using Oversubscription powers/money, using Billions of Dollars to maintain the price, the question is, until when can they do it?

Many reasons NOT to buy, but many reasons to USE Facebook. For me, until FB shows clear direction how they can earn the 1B a year, until then that I will think twice buying this stock.

Update#5. Dow,S&P fall below important support, 2 reasons for the next 1292-1303 support for S&P must hold, else we might see end of Medium Term Uptrend 5-18-2012

2 reasons why 1292-1303 are good support.

1. 1292 is the Minor Wave 1 of this Intermediate Wave 1 rally of Primary Wave III.

2. 1292-1303 is the retracement of the S&P drop in color Red, duplicating the range to a lower projection. It is pointing at 1292-1303 reflection.

I really hope that this is a correction as Minor Wave 4 correction of Intermediate Wave 1 of Primary Wave III rally. This is my count so far using Elliot Wave Analysis. Taking a look at DOW JONES WEekly Charts, we can see that Primary Wave I and its Intermediate Wave 1 rally has almost the same pattern, and Daily Rsi at 5 and Weekly RSI at 25 is technically good buy assuming this is still a Bull Market, which I think is still a YES.

Fall below 1292 and 12250 respectively for S&P and DOW can trigger bearish sentiment. For now, I count this as a correction.

Wednesday, May 16, 2012

Update #4, DOW,SPX slides slightly below important support, close to calling it a breakdown if doesnt go above, Germany GDP increases but all other Region has 0% to negative Growth 5-16-2012

SPX and Dow Jones have almost the same charts, and by simply looking the individual charts, it MAY have slipped through its important support lines at 1340 and 12700 respectively. I have drawn a GREEN uptrend line to foresee possible supports, and if ever in this coming days SPX and DOW rallied above 1340 and 12700, correction may end asap. Otherwise, a breakdown will happen and cause 2-4% more downside risk.

Furthermore, in case breakdown below levels, we should expect a very strong support near 12250-12500 and 1300-1313 based from Elliot wave structure.

Elliot Wave Wave 4 correction usually stops near Wave 1 rally. And looking at the charts, 12250-12500 and 1300-1313 is in place, that’s the last barrier Markets should hold, else, we may see huge sell-offs going back to Oct 2011 lows.

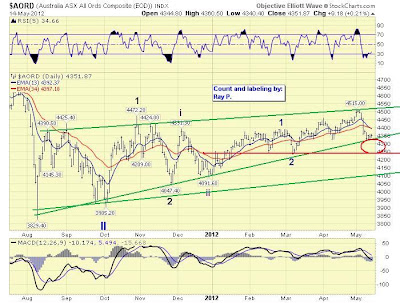

Australia broke its important 10 months uptrend line, and now on a sideways/downtrend pattern. Next support is at 4250, else 4100.

HongKong Markets already slipped almost 10% from its 2012 highs, and still beaten by a mere 3.3% selloff. Making it close at 19259. I lowered the expected 19500 support to 19250, coinciding with today’s close. If tomorrow selloff persist in this market, a deterioration near 18000 is possible. At current 9x P/E, this market should be really attractive in valuation.

In Europe, only Germany is expected to hold into its uptrend cycle, while we expect France and UK to break below its uptrend line, and best advice to be sideways pattern to reflect their 0% QoQ growth for 2012 and Recession for UK.

Monday, May 14, 2012

Update #3 Dow Futures -100, Technical Support still intact on Major Index, must hold else more downturns coming 5-14-2012

Dow Futures -100 as of 8pm SGT. Europe has -2%

each, and computing for the net loss of Europe as of this moment,

Support of DAX, CAC and FTSE still intact and uptrend, Germany's Q1 2012

will decide this Wednesday if Market will hold or breakdown.

Elliot Wave Suggests that DOW is currently in Intermediate Wave IV correction of Major Wave 1 of Primary Wave III Bull Market. If this is indeed a correction and Intermediate Wave IV, expected end of selloff is around 12500-12750.

In Asia, Singapore was the first to breakdown of its important support at 2920, next stop is possible at 2750-2800. Next is Philippines, which broke down its strong uptrend/parabolic rally, supports at 5000,4850 then 4600. at 19.7 P/E, Philippines needs some break and long consolidation.WTIC Oil is also hovering on a sideways pattern and broke its strong short term uptrend line. Support should be around 92-94.

In Asia, Singapore was the first to breakdown of its important support at 2920, next stop is possible at 2750-2800. Next is Philippines, which broke down its strong uptrend/parabolic rally, supports at 5000,4850 then 4600. at 19.7 P/E, Philippines needs some break and long consolidation.WTIC Oil is also hovering on a sideways pattern and broke its strong short term uptrend line. Support should be around 92-94.

Friday, May 11, 2012

Tuesday, May 8, 2012

Global Market Skids, Technical Support intact 5-8-2012

Markets sell-off overnight especially Asia taking a double hit. -1.2% for the dow, and another 1.3% negative in futures. Most Asia Index lost 3%, and for me, support is there and might be an opportunity for this market.

Next week Wednesday is the next magical numbers everyone is waiting, Germany's Q1 2012 GDP. If GDP is good (above 0.0% growth), this so called sell-off will result to good returns. That made me decide to enter 15% into the markets yesterday. Especially HK and AU. And planning to enter more up to next week.

aa

Saturday, May 5, 2012

GDP numbers around the globe 5-5-2012

Tracking Global GDP status. Germany and France are awaited to give results, as double dip recession was recently confirmed to UK and Spain.

Others look consistently strong,but others are near Recession level.

Annualized GDP

Q2 2011

|

Q3 2011

|

Q4 2011

|

Q1 2012

| ||

UK

|

0.40%

|

0.30%

|

0.50%

|

0.00%

|

recession

|

Germany

|

3.00%

|

2.60%

|

1.50%

| ||

France

|

1.60%

|

1.55%

|

1.41%

| ||

United States

|

1.60%

|

1.50%

|

1.60%

|

2.10%

| |

Singapore

|

1.20%

|

6.00%

|

3.60%

| ||

South Korea

|

3.50%

|

3.60%

|

3.40%

|

2.80%

| |

Australia

|

1.10%

|

2.50%

|

2.30%

| ||

Hong Kong

|

5.30%

|

4.30%

|

3.00%

| ||

Philippines

|

3.10%

|

3.60%

|

3.70%

| ||

China

|

9.50%

|

9.10%

|

8.90%

|

8.10%

|

QoQ GDP Growth

Q2 2011

|

Q3 2011

|

Q4 2011

|

Q1 2012

| |

UK

|

-0.10%

|

0.60%

|

-0.30%

|

-0.20%

|

Germany

|

0.30%

|

0.60%

|

-0.20%

| |

France

|

-0.10%

|

0.20%

|

0.30%

| |

United States

|

1.30%

|

1.80%

|

3.00%

|

2.20%

|

Singapore

|

-3.00%

|

2.00%

|

-2.50%

| |

South Korea

|

0.80%

|

0.80%

|

0.40%

|

0.90%

|

Australia

|

1.40%

|

0.80%

|

0.40%

| |

Hong Kong

|

-0.50%

|

0.10%

|

0.40%

| |

Philippines

|

0.30%

|

0.80%

|

0.90%

|

Subscribe to:

Comments (Atom)