Gold – bull market or just a bear market rally

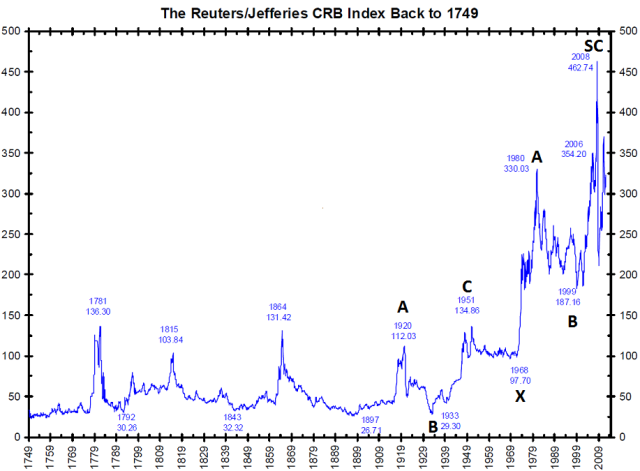

While many are touting a new bull market in Gold, and Silver for that matter, history suggests otherwise. When we look back at the history of commodity prices for the past two centuries we observe generally short bull markets followed by longer bear markets. Since Gold was fixed for most of this period a chart going that far back would be of little use.

Notice for over 200 years commodities remained in a trading range. Demand drove prices up, then oversupply brought prices right back down. This all changed when the US went off the Gold standard in 1971. Commodity prices soared, along with Gold, and the bull/bear cycles became more uniform.

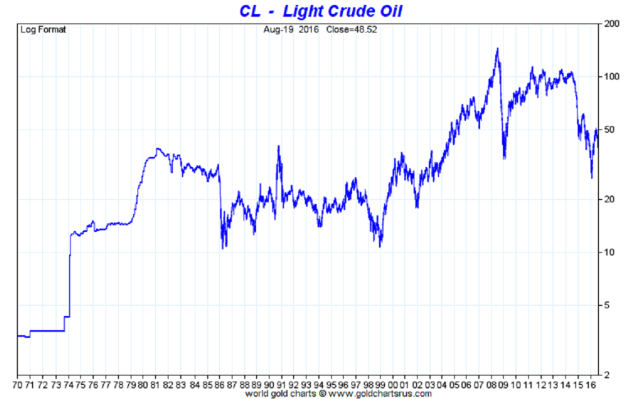

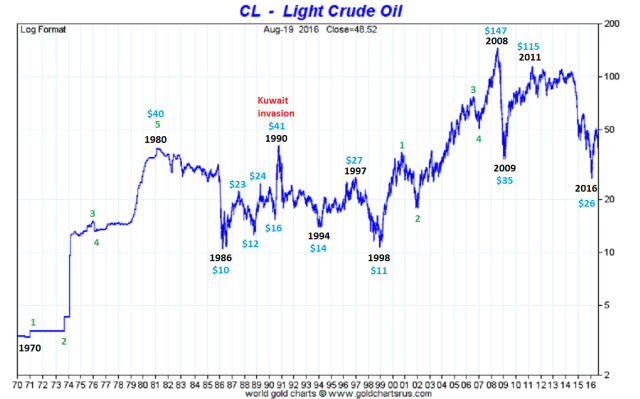

Gold has had two bull markets since then: 1970-1980, and 2001-2011. In between was a lengthy two decade bear market. The same pattern, with slightly altered dates, can be found in most of the commodities. For example, Crude had a bull market from 1970-1980 and another bull market from 1998-2008. In between was a lengthy two decade bear market. And Crude is currently still well below its bull market high of $147/bbl.

When we examine the last Gold bear market in detail we find it had three significant rallies during its 1980-2001 bear market. One in the early 1980’s, another in the mid-80’s, and the third in the mid-90’s. The first two rallies retraced only 38.2% of the previous larger declines, and the last retraced about 50%.

If we then apply these retracement levels to the current bear market rally we arrive at some interesting potential price targets. A 38.2% retracement of the entire 2011-2015 decline is $1381, and a 50% retracement is $1485. Since Gold has already risen to $1377, and if it clears the $1381 level, the 50% retracement level is probably the target. If we then compare the three waves within this advance we find that Major C equals Major A at $1463. This gives us an upside target for the entire bear market rally between $1463 and $1485 in the weeks and months ahead.

This is just an observation based upon historical and current wave formations, and not a trading or investment recommendation. You can follow Gold along with us using the following link: https://stockcharts.com/public/1269446/tenpp/10

All information were from Tony Caldaro.

Reposted to share the information.