12-17-2010 : Getting weaker and weaker

U.S. markets getting .30% to .1% gain everyday, good or bad? Its good in some ways, but it shows weakness especially like the scenario today, of the fresh breakout above 10400 (52 week) which is weak in creating new highs.

I am AFRAID but Its about time or around end of the month or max of 1st week of January before we see the 5-10% bigger correction than what we had last November. I am still trying to pray that there is a xmas rally, (kahit hngang dec 25 lang, kasi ang baba na natin PSE compared to other countries.) As early as now, me too is trying to get out of the market as of this moment. And reentering in 1-2mos when there is a good correction.

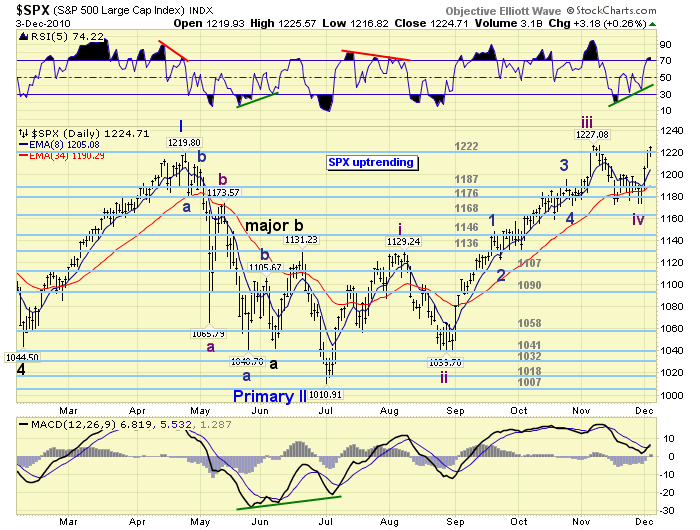

I highlighted in Pink the possible movement of the DOW of target 10400-10700 ( 5-10%) correction. Possible reasons: MACD getting negative divergence, RSI getting negative divergence also.

Correction is healthy, yet we don’t want correction to hit our gains. Be careful.

PSE market.

“I am AFRAID but Its about time or around end of the month or max of 1st week of January before we see the 5-10% bigger correction than what we had last November. I am still trying to pray that there is a xmas rally, (kahit hngang dec 25 lang, kasi ang baba na natin PSE compared to other countries.) As early as now, me too is trying to get out of the market as of this moment. And reentering in 1-2mos when there is a good correction. “

Last month, I still believe 5k or 5.5k is attainable in 2011. But today, I am still realizing and eating the “SAYANG” of what the massive rally we got, we should learn how to know if we are in a bubble. And now it popped, everyone’s hurt, and still huring IF DOW gets the expected correction.

TIPS: Slowdown on buying, especially on the Short term downtrend indiv stocks, better short some if there will be a XMAS rally. On the brighter side, if we breakout the pink downtrend line, 2011 will be a very good yr maxing of around 4500-4700 in 12 mos.

SHORT TERM DOWNTREND: almost all properties, almost banks, some conglomerates

Consolidating: POWER

THESE ARE JUST GUIDES TO THE MARKET. YOU MAY OPT TO DO YOUR VERY OWN TRADES.