Thursday, September 25, 2014

Wednesday, September 24, 2014

SPX Elliot Wave - THREE COMPLETE SCENARIOS 9-25-2014

Updates from our last post SPX THREE COMPLETE ELLIOT WAVE SCENARIOS (8-28-2014)

Looks like scenario #3 is still the current count and pretty much extending.

SCENARIO#1 SPX makes new high and is finishing Int Wave 3 or have finished, semi BULLISH count (30% chance)

SPX is finishing Int Wave 3 of Major Wave 5 of Primary Wave III, or could have finished if SPX drops below 1900.

If SPX drops 1870-1930 and begins to rally and make new highs, we can forecast Int Wave 5 of end Primary Wave III will be around 2040(0.618% of Int 1) to 2140 (Int 5 = Int 1)

SCENARIO#2 SPX makes new high, long way to go, VERY BULLISH COUNT(20% chance)

This count suggests that SPX just finished Major Wave 3 and has very long way to go to the upside.

Based on Primary I x 1.618 = Primary III. Target could be around 2230.

This is a VERY bullish scenario and for presentation only(with fibonacci retracements/targets) but not the preferred count as of this moment.

SCENARIO#3 SPX makes new high, few more room left, BEARISH COUNT(50% chance and bearish consolidation due next)

I am a little upset that SPX could be extending again.

Based from the price movement, this count suggests that Int wave iv is subdividing, and a tentative minor 1 and minor 2 is placed on the chart.

minor 3 have a target of 2040-2060 upside. and end of minor 5 can be around Oct-Nov 2014.

A fall below 1900 will invalidate this extension and our old forecast that Int v of Major 5 of Primary III ends at 2019.

*All scenarios put 1900 as an important pivot point for Elliot Wave counting.

Good luck. Cheers!

Looks like scenario #3 is still the current count and pretty much extending.

SCENARIO#1 SPX makes new high and is finishing Int Wave 3 or have finished, semi BULLISH count (30% chance)

SPX is finishing Int Wave 3 of Major Wave 5 of Primary Wave III, or could have finished if SPX drops below 1900.

If SPX drops 1870-1930 and begins to rally and make new highs, we can forecast Int Wave 5 of end Primary Wave III will be around 2040(0.618% of Int 1) to 2140 (Int 5 = Int 1)

SCENARIO#2 SPX makes new high, long way to go, VERY BULLISH COUNT(20% chance)

This count suggests that SPX just finished Major Wave 3 and has very long way to go to the upside.

Based on Primary I x 1.618 = Primary III. Target could be around 2230.

This is a VERY bullish scenario and for presentation only(with fibonacci retracements/targets) but not the preferred count as of this moment.

SCENARIO#3 SPX makes new high, few more room left, BEARISH COUNT(50% chance and bearish consolidation due next)

I am a little upset that SPX could be extending again.

Based from the price movement, this count suggests that Int wave iv is subdividing, and a tentative minor 1 and minor 2 is placed on the chart.

minor 3 have a target of 2040-2060 upside. and end of minor 5 can be around Oct-Nov 2014.

A fall below 1900 will invalidate this extension and our old forecast that Int v of Major 5 of Primary III ends at 2019.

*All scenarios put 1900 as an important pivot point for Elliot Wave counting.

Good luck. Cheers!

Sunday, September 21, 2014

USDPHP target 45:1 in case Head and Shoulder pattern explodes 9-22-2014

Strength in USD currency has gained momentum making other currencies weak especially EUR.

USDPHP has also an awful Head and Shoulder pattern with a usual target of 45:1.

Although in currencies, HNS is very rare, we might take a chance to look that it may develop and hit our target, but on a lower chance compared to HNS in stocks/equities.

Tuesday, September 16, 2014

Steady buyback on US Corporate High Yield Bonds 9-17-2014

Part of my portfolio is medium risk funds/investments with monthly dividends, Added more today Allianz US High Yield Fund - U62498(HSBC Code) as fund price is near 2011 lows due to steady increase in US Treasury % and end of QE3 which is bond buying.

This fund is rated as 3 out of 5 by HSBC, and Morningstar Rating of 3 out of 5 stars

This fund mostly consists of US Corporate Debts which I prefer compared to European or High Debt countries like Portugal, Spain, Greece and so on.

Could also be referred as "Junk Bonds" since mostly having Credit Rating of BB and below

Dividend Yield raised to 7.97% as Fund price went down to 9.85

My average price: 10.20

Current Price: 9.85

Cash Available: 60%

Strategy:

I unloaded during 10.40 levels and steadily doing buybacks for Monthly Dividends

My strategy is Long Term Cost averaging, Monthly dividend collection and will unload on probable US Bull Market peak

*HY Bonds usually are flactuating and direct reasons are US Stock market, European Stock Market, Corporate Cashflow itself and Goverment Treasury Yields

** This fund is offered by Allianz and available mostly on any broker

***Listed in Bloomberg

Tuesday, September 9, 2014

Tuesday, September 2, 2014

REPOST: Not just Argentina: Other nations in debt doldrums 9-2-2014

Argentina's lengthy debt saga returned to the spotlight

this week, with its second default in only 12 years triggering George

Soros and other investors to sue Bank of New York Mellon for withholding

interest payments.

This came after Argentina refused to comply with a U.S. legal ruling ordering it to repay $1.3 billion to creditors, triggering a selective default. Moody's Investors Service downgraded its outlook for the country's debt to "negative" at the end of July and confirmed its long-term credit rating at "Caa1"—meaning it views Argentine debt as a highly risky investment at the precarious end of the "junk bond" spectrum.

This came after Argentina refused to comply with a U.S. legal ruling ordering it to repay $1.3 billion to creditors, triggering a selective default. Moody's Investors Service downgraded its outlook for the country's debt to "negative" at the end of July and confirmed its long-term credit rating at "Caa1"—meaning it views Argentine debt as a highly risky investment at the precarious end of the "junk bond" spectrum.

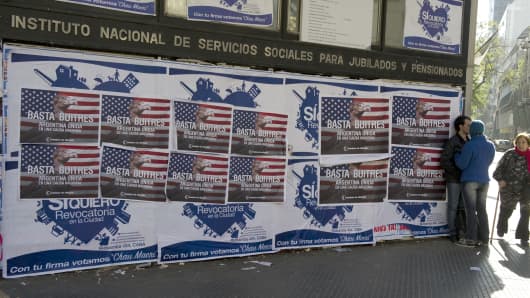

Posters on a wall against the 'vulture funds' in Buenos Aires, Argentina.

Argentina is, nonetheless, only one of several

countries whose shaky finances leave them on the brink of being unable

to repay their obligations. Moody's currently rates 10 other countries'

debt as equally or even more risky than that of Argentina. These span

the globe, from nearby by Venezuela and Ecuador to Pakistan and Greece.

Read MoreAre risky European bonds in a bubble?

The table below shows the countries around the world judged as most likely to default on their sovereign debt by Moody's. Countries rated Caa1, like Egypt, are judged as risky as Argentina, while those rated Caa2 or Caa3 are even more speculative:

Read MoreAre risky European bonds in a bubble?

The table below shows the countries around the world judged as most likely to default on their sovereign debt by Moody's. Countries rated Caa1, like Egypt, are judged as risky as Argentina, while those rated Caa2 or Caa3 are even more speculative:

Other countries further up the junk bond spectrum still

cause concern, like Ghana, whose credit rating was downgraded in June

and has announced it might tap the International Monetary Fund (IMF) for

a loan as soon as next month.

Ukraine

Ukraine's economic recession has deepened over the past few months, with a sharp fall in industrial production as the conflict with Russia drags on. Macroeconomic research firm Capital Economics forecasts Ukraine's economy contracted by around 5 percent year-on-year in July, following a 4.7 percent year-on-year fall in the second quarter.

"We are only just seeing the economic impact on the conflict in the East in the numbers," Nomura Emerging Market Economist Peter Attard Montalto told CNBC on Wednesday.

"Write-downs and restructurings are possible in Ukraine as the currency slides further, growth continues to surprise to the downside and the overall debt burden continues to climb."

Ukraine

Ukraine's economic recession has deepened over the past few months, with a sharp fall in industrial production as the conflict with Russia drags on. Macroeconomic research firm Capital Economics forecasts Ukraine's economy contracted by around 5 percent year-on-year in July, following a 4.7 percent year-on-year fall in the second quarter.

"We are only just seeing the economic impact on the conflict in the East in the numbers," Nomura Emerging Market Economist Peter Attard Montalto told CNBC on Wednesday.

"Write-downs and restructurings are possible in Ukraine as the currency slides further, growth continues to surprise to the downside and the overall debt burden continues to climb."

Russian armored carrier leads a column of military trucks as they leave the Ukrainian border around Kamensk-Shakhtinsky, Russia.

Moody's downgraded Ukrainian bonds to Caa3 with negative

outlook in April this year—two notches below Argentina. The agency

cited Ukraine's escalating geopolitical crisis and stressed external

liquidity position, the withdrawal of Russian financial support and a

rise in gas import prices. It sees Ukraine's debt-to-GDP ratio hitting

55-60 percent by the end of the year, up from 40.5 percent at end-2013.

Nonetheless, economists view a formal default as unlikely given the amount of international assistance Ukraine is receiving. The European Union has pledged 11 billion euros ($14.5 billion) to help the country, with another $17 billion coming from the IMF.

"The level of international support is still so great that any (debt) restructuring, if it were ever to occur, is likely to be pushed out as far as possible," said Attard Montalto.

Egypt

Three years after the "Arab Spring" revolution, unsettled political conditions continue to weaken Egypt's economy.

Back in March last year, Moody's downgraded Egypt's sovereign debt to Caa1 with "negative outlook"—exactly the same view it now holds on Argentina. It warned there was a 40 percent possibility of Egypt defaulting within the next five years.

Nonetheless, economists view a formal default as unlikely given the amount of international assistance Ukraine is receiving. The European Union has pledged 11 billion euros ($14.5 billion) to help the country, with another $17 billion coming from the IMF.

"The level of international support is still so great that any (debt) restructuring, if it were ever to occur, is likely to be pushed out as far as possible," said Attard Montalto.

Egypt

Three years after the "Arab Spring" revolution, unsettled political conditions continue to weaken Egypt's economy.

Back in March last year, Moody's downgraded Egypt's sovereign debt to Caa1 with "negative outlook"—exactly the same view it now holds on Argentina. It warned there was a 40 percent possibility of Egypt defaulting within the next five years.

"Egypt's sovereign balance sheet (including low FX

reserves) and external accounts worsened dramatically since the start of

the Arab Spring in early 2011 and are very fragile," Slim Feriani,

executive chairman of Advance Emerging Capital, told CNBC last week.

One concern is the county's reliance on economic aid from its neighbors in the Gulf—and what could happen if that flow dried up. To date, Saudi Arabia, Kuwait, and the United Arab Emirates have pledged over $18 billion in direct loans, fuel subsidies, and grants to the Egyptian government, with billions more being invested from the private sector in residential housing and commercial real estate.

"Egypt's risk of balance of payment crisis and sovereign default are huge if it were 'left on its own' without 'artificial short-term external help'," Feriani told CNBC.

Ghana

The lower-middle income country in sub-Saharan Africa sought assistance from the IMF earlier in August, in a dramatic U-turn for the government, who only days before had said it wasn't considering a loan.

The move did not surprise currency traders however, who had watched the Ghanaian cedi tank nearly 60 percent against the U.S. dollar this year—following a 20 percent decline in 2013.

Moody's downgraded Ghana's sovereign rating by one notch from B1 to B2 with a negative outlook in June, citing its high and rising debt burden. It forecast Ghanaian public debt will exceed 65 percent of GDP by end-2015, up from 55.7 percent last year.

One concern is the county's reliance on economic aid from its neighbors in the Gulf—and what could happen if that flow dried up. To date, Saudi Arabia, Kuwait, and the United Arab Emirates have pledged over $18 billion in direct loans, fuel subsidies, and grants to the Egyptian government, with billions more being invested from the private sector in residential housing and commercial real estate.

"Egypt's risk of balance of payment crisis and sovereign default are huge if it were 'left on its own' without 'artificial short-term external help'," Feriani told CNBC.

Ghana

The lower-middle income country in sub-Saharan Africa sought assistance from the IMF earlier in August, in a dramatic U-turn for the government, who only days before had said it wasn't considering a loan.

The move did not surprise currency traders however, who had watched the Ghanaian cedi tank nearly 60 percent against the U.S. dollar this year—following a 20 percent decline in 2013.

Moody's downgraded Ghana's sovereign rating by one notch from B1 to B2 with a negative outlook in June, citing its high and rising debt burden. It forecast Ghanaian public debt will exceed 65 percent of GDP by end-2015, up from 55.7 percent last year.

Exotix Partners Chief Economist Stuart Culverhouse said

the government has been in denial about the severity of Ghana's

financial straits—which include hefty fiscal and current account

deficits, rising inflation and low foreign exchange reserves.

"Rather than tighten fiscal policy in line with available financing, the government seems determined to continue its expansionary stance," Culverhouse said in a fixed income note this month.

Moody's thinks IMF intervention will be a "credit positive" for Ghana, if it leads to a program aimed at stemming the fiscal overruns and inflationary pressure driving the cedi's depreciation. The IMF plans to start discussions about a program in September.

"Rather than tighten fiscal policy in line with available financing, the government seems determined to continue its expansionary stance," Culverhouse said in a fixed income note this month.

Moody's thinks IMF intervention will be a "credit positive" for Ghana, if it leads to a program aimed at stemming the fiscal overruns and inflationary pressure driving the cedi's depreciation. The IMF plans to start discussions about a program in September.

http://www.cnbc.com/id/101953868

Subscribe to:

Posts (Atom)