Wednesday, December 17, 2014

Tuesday, December 16, 2014

Monday, December 15, 2014

(bad effects of low oil) Russia raises key rate to 17%, effective Tuesday 12-16-2015

Russia raises key rate to 17%, effective Tuesday

Russia on Monday announced that it would hike its

key interest rate to 17 percent, effective Tuesday, citing rising

devaluation and inflation risks.

The bank had raised the rate to 10.5 percent last week in an effort to stem a run on its currency.

"This decision is aimed at limiting substantially increased ruble depreciation risks and inflation risks,'' the central bank said in a statement. The decision is effective starting Dec 16.

Earlier on Monday, the Russian ruble saw its biggest drop against the dollar since 1998. It strengthened after the rate decision and was last trading at 62.50 rubles per dollar, compared to 65.50 before the announcement.

The announcement comes on the back of a plunge in the price of oil—Russia's main export and revenue source. The country also faces headwinds from Western sanctions over its conflicts with Ukraine.

The bank had raised the rate to 10.5 percent last week in an effort to stem a run on its currency.

"This decision is aimed at limiting substantially increased ruble depreciation risks and inflation risks,'' the central bank said in a statement. The decision is effective starting Dec 16.

Earlier on Monday, the Russian ruble saw its biggest drop against the dollar since 1998. It strengthened after the rate decision and was last trading at 62.50 rubles per dollar, compared to 65.50 before the announcement.

The announcement comes on the back of a plunge in the price of oil—Russia's main export and revenue source. The country also faces headwinds from Western sanctions over its conflicts with Ukraine.

Pedro SalaverrAa

Dennis Gartman, editor and publisher of "The Gartman

Letter," said that while the move could perk up the currency in the

short term, the country may regret the decision later.

"All it is is a temporary stem in the decline of the ruble," Gartman told CNBC Monday. "The problems that it's going to create for the Russian economy, for the Russian people and for Mr. Putin, [will be] very severe."

Gartman sees the ruble trading at 100 against the dollar soon. The currency has tumbled some 50 percent year-to-date.

"This is really extraordinary to watch," Gartman said. "I wouldn't be surprised at all if the Russians we selling gold, they have no choice. What else can they sell? They can't sell any crude oil anymore."

The Kremlin recently trimmed its growth forecast for 2015, predicting that the economy will sink into recession.

In September, the United States and the European Union imposed a new round of sanctions for Moscow's actions in Ukraine, which included blocking Western financial markets to key Russian companies and limiting imports of some technologies.

The additional sanctions were expected to cause enough pain to put Russia into recession for one or two years, predicted economist Alexei Kudrin, who served as finance minister under President Vladimir Putin for 11 years until 2011.

The potential for a prolonged downturn caused investors to pull their money from the capital, causing the ruble to further lose value.

The Associated Press contributed to this report.

"All it is is a temporary stem in the decline of the ruble," Gartman told CNBC Monday. "The problems that it's going to create for the Russian economy, for the Russian people and for Mr. Putin, [will be] very severe."

Gartman sees the ruble trading at 100 against the dollar soon. The currency has tumbled some 50 percent year-to-date.

"This is really extraordinary to watch," Gartman said. "I wouldn't be surprised at all if the Russians we selling gold, they have no choice. What else can they sell? They can't sell any crude oil anymore."

The Kremlin recently trimmed its growth forecast for 2015, predicting that the economy will sink into recession.

In September, the United States and the European Union imposed a new round of sanctions for Moscow's actions in Ukraine, which included blocking Western financial markets to key Russian companies and limiting imports of some technologies.

The additional sanctions were expected to cause enough pain to put Russia into recession for one or two years, predicted economist Alexei Kudrin, who served as finance minister under President Vladimir Putin for 11 years until 2011.

The potential for a prolonged downturn caused investors to pull their money from the capital, causing the ruble to further lose value.

The Associated Press contributed to this report.

Karma AllenNews Associate

https://www.blogger.com/blogger.g?blogID=5548660505688581623#editor/target=post;postID=2995300463938075967

Sunday, December 14, 2014

Oil nose dives. 26pesos per liter of Diesel price, highly probable 12-15-2015

WTIC did another nasty dive and broke below important supports. Although this could be already in the bottoming process, long candles which typically could reverse anytime. We should also discuss what other problems it could encounter if WTIC stays below these levels.

Saudi and Russia are widely known to have a lot of oil deposits and oil exports is one of their income generating for GDP. Now that WTIC has fallen almost 50% of the price since 2011 or 2013. It could really make a big effect, especially for Russia,who had a bad record last 1998 when it's country's debt defaulted, Oil slump that time was also one of the reasons they were not able to pay off their debt,then coincided with 2000 tech bubble.

I believe 50s level is an important support, and a breakeven cost to oil explorers. U.S. got a lot of production which lessened their Oil imports. It could be an oversupply, but it could also be a political strategy by the US and Oil traders.

Consumers will GREATLY benefit from this, but thinking on a bigger picture, when we revisit 33USD (2009 lows), a lot of Countries and Corporate debt will default. Which could spark the next recession. Just saying....

Diesel price estimates for the Philippines

58USD x 44.50 USD/peso = 2581 / 119.24= 21.64pesos/liter X additional 20-30% profit/margin = 26-28 pesos per liter of Diesel, highly probable.

Thursday, December 4, 2014

Wednesday, December 3, 2014

China confirmed bull market, and HK targets 12-4-2014

Since Q3 of 2014. We are closely monitoring China market. We indicated that a sudden movement to the upside was encountered last August 2014,and a break above 2200 level could trigger a possible start of bull market for China. Helped by cheap oil, lessening their oil imports expenses.

We did notice that after going above 2200 level, China became very strong since 2009 recession.

We still continue to expect this market to go on uptrend.

Targets and resistances:

2850 (61.8% retracement of 2010 peak, uptrend resistance of Nov 2011)

3150 (76.2% retracement of 2010 peak, uptrend resistance of July 2011)

3450 (2010 peak and 31.8% retracement of 2009 peak)

All targets and resistances has 2 or more technical reasons. I believe it will just be the start of China's Bull market.

One market that will benefit China Bull market in case it starts to go strong is Hong Kong.

HK is one of the weakest since 2009 recession and once of the markets that was not able to revisit 2009 in Asia.

Uptrend since 2009 is still intact, and always get bumped and was a great BUY opportunity, now that China is getting strong, we may see HK go strong as well.

First target is around 25300-26000 where 2014 high is and medium term resistance of Nov 2013.

27500 is also an uptrend resistance where medium term uptrend since Nov 2011 is located.

I may not be thinking correct, but in case it is a full blown bull market like the US, HK can reach as high as 33,000. Though let us not think of it as of this moment. :)

*** this China Bull market thing is against our expectation of an ending Primary III in the US, where Primary IV coming next(hoping Q4 2014 to Q1 2015). It could still be a China Bull market, but dont expect a straight line up. Just pointing out next target resistances. China and HK is one of the weakest primary markets in the world, let us give them a chance to shine at least getting back 50% or 61.8% from their 2007 highs.

Thursday, November 27, 2014

WTIC 4 year low 11-27-2014

WTIC lost 4% overnight and hit its 4year low. It also exceeded and broke below the important 74-76 area of support.

We may see some support around 70-71 which is the downtrend support since 2011 high. Followed by a good bounce as the drop from 107 to 72 is not very healthy without a bounce. (-33%)

We can roughly say that Oil could be in Bear market and downtrend lines since 2011 is still intact.

72USD x 44.95 / 119.24 Liters = 27.14 pesos per liter

Assuming + 20% gross profit margin and expenses = 32.50 pesos per liter

We may see Diesel prices here in the Philippines to hit as low as 32.50 soon. (now at 35.10).

*Xmas rush + cheap oil prices = disastrous traffic here in Manila x.x

Monday, November 10, 2014

Market snapshots: FTSE, DAX, PSEi, JKSE, HSI and China 11-11-2014

I know we are all upset with the US and Europe ending with a V-shape

recovery vs our expected Major B lower high to end another selloff to

Major C to finish Primary Wave IV. Our xmas rally play was ripped off..

Europe(Germany and FTSE) both hit their downside targets(13-15%) which may have sparked the bottom and led the recovery.

Anyhow, let us continue to monitor and adjust things accordingly.

Thursday, October 23, 2014

WTIC update and expecting a bottom 10-24-2014

In relation to our post for WTIC 2 weeks ago http://theamazingchart.blogspot.com/2014/10/wtic-reached-oct-2012-lows-10-10-2014.html

WTIC managed to get as low as 79.xx intraday. As US selloff made Oil traders cash out as well. I expect WTIC to hold around 77-81 level and bounce 3-6months to around 90-100 level.

In terms of price here in the Philippines. 81USD per barrel = 82 x 44.80 / 119.24(liters per barrel) = 30.80 pesos per liter.

Adding their gross profit margin and inventory costs of 20%. 30.80 + 20% margin = Diesel prices of 36.96 pesos per liter could be the bottom.

Low WTIC could increase profits of companies and decrease inflation, make car owners happy and increase traffic.

GDP wise, low WTIC can be economical friendly, but don't expect to hold at these low levels.

* break below of 77-81 could bring WTIC to 67-73 level.

WTIC managed to get as low as 79.xx intraday. As US selloff made Oil traders cash out as well. I expect WTIC to hold around 77-81 level and bounce 3-6months to around 90-100 level.

In terms of price here in the Philippines. 81USD per barrel = 82 x 44.80 / 119.24(liters per barrel) = 30.80 pesos per liter.

Adding their gross profit margin and inventory costs of 20%. 30.80 + 20% margin = Diesel prices of 36.96 pesos per liter could be the bottom.

Low WTIC could increase profits of companies and decrease inflation, make car owners happy and increase traffic.

GDP wise, low WTIC can be economical friendly, but don't expect to hold at these low levels.

* break below of 77-81 could bring WTIC to 67-73 level.

Tuesday, October 14, 2014

Elliot Wave SPX 10-15-2014

Elliot Wave Analysis has confirmed that we are now entering Primary IV correction. And our three scenarios for SPX that we are continuing to monitor has confirmed that this is the most probable count as of this moment.

The break below of 1906 or Int iv of Major 5 has confirmed that the correction was much of a greater degree and option for that new low was that we are now in Primary IV correction which consists of Major A, Major B and Major C.

We also broke below the RED uptrend line since June 2013 which suggests that we have medium term target of 1800.

Positively speaking on the short term, RSI hit 31 and MACD is low, suggesting that we may see Major A ending soon. Rough idea should be around 1818-1874. Then a bounce to 1927(38.2% retracement) or 1906(23.6% retracement) before Major C low.

We need to see Major A first before we can predict Major C.

For now, let us see if Major A extends to the downside or Major B is ready to make short term rally.

Sunday, October 12, 2014

PSEi Philippines index analysis 10-13-2014

It has been a long time since I posted PSEi chart.

Our last play earlier this year was to enter 5800-6000 but was able to unload very early around 6700-6900 on almost half of my holdings. I got scared when we freely moved 7200-7400 without concrete resistances(it is the area where 2013 peak and most people got stucked). PE also reached 21.5x at 7400.

We laid out 11months uptrend support since PSEi bottomed at 5800. The 7400 peak could be a double top pattern.

Important support to look into is the uptrend line since 5800. It should be around 7000 where strictly speaking must hold else medium term trend could be to the downside.

Market is still 7000 level as of 2pm 10/13/2014. But in case it breaks below 7000.

Immediate supports will be 6900 and 6700, and technically speaking, it could be as low as 6400.

2009-2014 Bull Market uptrend line is around 6000. If there is a chance it goes to that level, it is a no brainer ALL-IN.

Goodluck. Cheers! :)

*maintaining 85% cash

Germany and London FTSE, confirmed in downtrend, target downside and supports 10-13-2014

We are closely monitoring Germany for the past days/weeks. And the Head and Shoulder formation was confirmed when it closed 2.3% lower last Friday to 8788. The neckline was 9000 and Head and Shoulder pattern was clearly in place.

We laid down some important supports or target downside for Germany

1st - 2year uptrend line since 2012(in BLUE) which broke down with target of 8500

2nd - Head and Shoulder pattern with target of 8000

38.2% retracement of entire Primary III since 2011 could also be around 8180 level

50% retracement of entire Primary III since 2011 could also be around 7500

Roughly saying, if Germany also enters Primary Wave IV, we have a target of 7500-8180 at most or 8000-8500 as a safer bet. Charts looks oversold with RSI 22.

* 2009-2014 bull market uptrend line is at 6750.

London also joined the selloff when it broke below the descending triangle. We are closely monitoring the formation since it began pushing upwards to the 6850 level to make new highs for the year. It managed to hit 6850 6times this year but often closed below that level.

The descending triangle formation has a very low target of 6000-6100.

Other immediate supports are 6337 and 6030

Fibonacci retracements from 2011 lows have a target 6000(38.2%) and 5850(50%)

while Fobonacci retracements from 2012 lows have a target of 6300(38.2%) and 6000(50%)

Roughly saying, London FTSE with RSI of 24 can get lower with target downside of 6000-6300.

* 2010-2014 uptrend line has a strong support at 6000.

Thursday, October 9, 2014

WTIC reached Oct 2012 lows 10-10-2014

WTIC or Crude Oil reached its Oct 2012 lows after breaking below 91USD per barrel.

We may see support near 84 which is the Oct 2012 lows and I have a guess that we will bounce from here.

As of the meantime, Philippines may expect below 40pesos per liter for Diesel, hurraayy! And a lot of traffic in exchange. Booo ! haha.

Tuesday, October 7, 2014

London, Germany and Russell. Making markets look spooky! 10-8-2014

Germany is looking scary as of this moment. The Head and Shoulder pattern is in place and is now the 3rd time to have a base around 9000 level.

A break below 9000 will confirm multiple supports including the HnS pattern with a target of 8000.

Russell is also one of the markets we are looking at. It reached 1076 last night and is looking to break below 2014 support. A fall below have a target of 1000.

DOW,SPX and NASDAQ still is on uptrend but may be looking to follow once these 3 important index confirm something.

This week up to next week will be quite interesting, either we all bounce from these critical levels, or we all break below 2014 lows.

Thursday, September 25, 2014

Wednesday, September 24, 2014

SPX Elliot Wave - THREE COMPLETE SCENARIOS 9-25-2014

Updates from our last post SPX THREE COMPLETE ELLIOT WAVE SCENARIOS (8-28-2014)

Looks like scenario #3 is still the current count and pretty much extending.

SCENARIO#1 SPX makes new high and is finishing Int Wave 3 or have finished, semi BULLISH count (30% chance)

SPX is finishing Int Wave 3 of Major Wave 5 of Primary Wave III, or could have finished if SPX drops below 1900.

If SPX drops 1870-1930 and begins to rally and make new highs, we can forecast Int Wave 5 of end Primary Wave III will be around 2040(0.618% of Int 1) to 2140 (Int 5 = Int 1)

SCENARIO#2 SPX makes new high, long way to go, VERY BULLISH COUNT(20% chance)

This count suggests that SPX just finished Major Wave 3 and has very long way to go to the upside.

Based on Primary I x 1.618 = Primary III. Target could be around 2230.

This is a VERY bullish scenario and for presentation only(with fibonacci retracements/targets) but not the preferred count as of this moment.

SCENARIO#3 SPX makes new high, few more room left, BEARISH COUNT(50% chance and bearish consolidation due next)

I am a little upset that SPX could be extending again.

Based from the price movement, this count suggests that Int wave iv is subdividing, and a tentative minor 1 and minor 2 is placed on the chart.

minor 3 have a target of 2040-2060 upside. and end of minor 5 can be around Oct-Nov 2014.

A fall below 1900 will invalidate this extension and our old forecast that Int v of Major 5 of Primary III ends at 2019.

*All scenarios put 1900 as an important pivot point for Elliot Wave counting.

Good luck. Cheers!

Looks like scenario #3 is still the current count and pretty much extending.

SCENARIO#1 SPX makes new high and is finishing Int Wave 3 or have finished, semi BULLISH count (30% chance)

SPX is finishing Int Wave 3 of Major Wave 5 of Primary Wave III, or could have finished if SPX drops below 1900.

If SPX drops 1870-1930 and begins to rally and make new highs, we can forecast Int Wave 5 of end Primary Wave III will be around 2040(0.618% of Int 1) to 2140 (Int 5 = Int 1)

SCENARIO#2 SPX makes new high, long way to go, VERY BULLISH COUNT(20% chance)

This count suggests that SPX just finished Major Wave 3 and has very long way to go to the upside.

Based on Primary I x 1.618 = Primary III. Target could be around 2230.

This is a VERY bullish scenario and for presentation only(with fibonacci retracements/targets) but not the preferred count as of this moment.

SCENARIO#3 SPX makes new high, few more room left, BEARISH COUNT(50% chance and bearish consolidation due next)

I am a little upset that SPX could be extending again.

Based from the price movement, this count suggests that Int wave iv is subdividing, and a tentative minor 1 and minor 2 is placed on the chart.

minor 3 have a target of 2040-2060 upside. and end of minor 5 can be around Oct-Nov 2014.

A fall below 1900 will invalidate this extension and our old forecast that Int v of Major 5 of Primary III ends at 2019.

*All scenarios put 1900 as an important pivot point for Elliot Wave counting.

Good luck. Cheers!

Sunday, September 21, 2014

USDPHP target 45:1 in case Head and Shoulder pattern explodes 9-22-2014

Strength in USD currency has gained momentum making other currencies weak especially EUR.

USDPHP has also an awful Head and Shoulder pattern with a usual target of 45:1.

Although in currencies, HNS is very rare, we might take a chance to look that it may develop and hit our target, but on a lower chance compared to HNS in stocks/equities.

Tuesday, September 16, 2014

Steady buyback on US Corporate High Yield Bonds 9-17-2014

Part of my portfolio is medium risk funds/investments with monthly dividends, Added more today Allianz US High Yield Fund - U62498(HSBC Code) as fund price is near 2011 lows due to steady increase in US Treasury % and end of QE3 which is bond buying.

This fund is rated as 3 out of 5 by HSBC, and Morningstar Rating of 3 out of 5 stars

This fund mostly consists of US Corporate Debts which I prefer compared to European or High Debt countries like Portugal, Spain, Greece and so on.

Could also be referred as "Junk Bonds" since mostly having Credit Rating of BB and below

Dividend Yield raised to 7.97% as Fund price went down to 9.85

My average price: 10.20

Current Price: 9.85

Cash Available: 60%

Strategy:

I unloaded during 10.40 levels and steadily doing buybacks for Monthly Dividends

My strategy is Long Term Cost averaging, Monthly dividend collection and will unload on probable US Bull Market peak

*HY Bonds usually are flactuating and direct reasons are US Stock market, European Stock Market, Corporate Cashflow itself and Goverment Treasury Yields

** This fund is offered by Allianz and available mostly on any broker

***Listed in Bloomberg

Tuesday, September 9, 2014

Tuesday, September 2, 2014

REPOST: Not just Argentina: Other nations in debt doldrums 9-2-2014

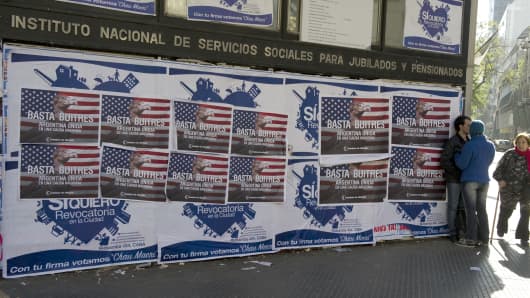

Argentina's lengthy debt saga returned to the spotlight

this week, with its second default in only 12 years triggering George

Soros and other investors to sue Bank of New York Mellon for withholding

interest payments.

This came after Argentina refused to comply with a U.S. legal ruling ordering it to repay $1.3 billion to creditors, triggering a selective default. Moody's Investors Service downgraded its outlook for the country's debt to "negative" at the end of July and confirmed its long-term credit rating at "Caa1"—meaning it views Argentine debt as a highly risky investment at the precarious end of the "junk bond" spectrum.

This came after Argentina refused to comply with a U.S. legal ruling ordering it to repay $1.3 billion to creditors, triggering a selective default. Moody's Investors Service downgraded its outlook for the country's debt to "negative" at the end of July and confirmed its long-term credit rating at "Caa1"—meaning it views Argentine debt as a highly risky investment at the precarious end of the "junk bond" spectrum.

Posters on a wall against the 'vulture funds' in Buenos Aires, Argentina.

Argentina is, nonetheless, only one of several

countries whose shaky finances leave them on the brink of being unable

to repay their obligations. Moody's currently rates 10 other countries'

debt as equally or even more risky than that of Argentina. These span

the globe, from nearby by Venezuela and Ecuador to Pakistan and Greece.

Read MoreAre risky European bonds in a bubble?

The table below shows the countries around the world judged as most likely to default on their sovereign debt by Moody's. Countries rated Caa1, like Egypt, are judged as risky as Argentina, while those rated Caa2 or Caa3 are even more speculative:

Read MoreAre risky European bonds in a bubble?

The table below shows the countries around the world judged as most likely to default on their sovereign debt by Moody's. Countries rated Caa1, like Egypt, are judged as risky as Argentina, while those rated Caa2 or Caa3 are even more speculative:

Other countries further up the junk bond spectrum still

cause concern, like Ghana, whose credit rating was downgraded in June

and has announced it might tap the International Monetary Fund (IMF) for

a loan as soon as next month.

Ukraine

Ukraine's economic recession has deepened over the past few months, with a sharp fall in industrial production as the conflict with Russia drags on. Macroeconomic research firm Capital Economics forecasts Ukraine's economy contracted by around 5 percent year-on-year in July, following a 4.7 percent year-on-year fall in the second quarter.

"We are only just seeing the economic impact on the conflict in the East in the numbers," Nomura Emerging Market Economist Peter Attard Montalto told CNBC on Wednesday.

"Write-downs and restructurings are possible in Ukraine as the currency slides further, growth continues to surprise to the downside and the overall debt burden continues to climb."

Ukraine

Ukraine's economic recession has deepened over the past few months, with a sharp fall in industrial production as the conflict with Russia drags on. Macroeconomic research firm Capital Economics forecasts Ukraine's economy contracted by around 5 percent year-on-year in July, following a 4.7 percent year-on-year fall in the second quarter.

"We are only just seeing the economic impact on the conflict in the East in the numbers," Nomura Emerging Market Economist Peter Attard Montalto told CNBC on Wednesday.

"Write-downs and restructurings are possible in Ukraine as the currency slides further, growth continues to surprise to the downside and the overall debt burden continues to climb."

Russian armored carrier leads a column of military trucks as they leave the Ukrainian border around Kamensk-Shakhtinsky, Russia.

Moody's downgraded Ukrainian bonds to Caa3 with negative

outlook in April this year—two notches below Argentina. The agency

cited Ukraine's escalating geopolitical crisis and stressed external

liquidity position, the withdrawal of Russian financial support and a

rise in gas import prices. It sees Ukraine's debt-to-GDP ratio hitting

55-60 percent by the end of the year, up from 40.5 percent at end-2013.

Nonetheless, economists view a formal default as unlikely given the amount of international assistance Ukraine is receiving. The European Union has pledged 11 billion euros ($14.5 billion) to help the country, with another $17 billion coming from the IMF.

"The level of international support is still so great that any (debt) restructuring, if it were ever to occur, is likely to be pushed out as far as possible," said Attard Montalto.

Egypt

Three years after the "Arab Spring" revolution, unsettled political conditions continue to weaken Egypt's economy.

Back in March last year, Moody's downgraded Egypt's sovereign debt to Caa1 with "negative outlook"—exactly the same view it now holds on Argentina. It warned there was a 40 percent possibility of Egypt defaulting within the next five years.

Nonetheless, economists view a formal default as unlikely given the amount of international assistance Ukraine is receiving. The European Union has pledged 11 billion euros ($14.5 billion) to help the country, with another $17 billion coming from the IMF.

"The level of international support is still so great that any (debt) restructuring, if it were ever to occur, is likely to be pushed out as far as possible," said Attard Montalto.

Egypt

Three years after the "Arab Spring" revolution, unsettled political conditions continue to weaken Egypt's economy.

Back in March last year, Moody's downgraded Egypt's sovereign debt to Caa1 with "negative outlook"—exactly the same view it now holds on Argentina. It warned there was a 40 percent possibility of Egypt defaulting within the next five years.

"Egypt's sovereign balance sheet (including low FX

reserves) and external accounts worsened dramatically since the start of

the Arab Spring in early 2011 and are very fragile," Slim Feriani,

executive chairman of Advance Emerging Capital, told CNBC last week.

One concern is the county's reliance on economic aid from its neighbors in the Gulf—and what could happen if that flow dried up. To date, Saudi Arabia, Kuwait, and the United Arab Emirates have pledged over $18 billion in direct loans, fuel subsidies, and grants to the Egyptian government, with billions more being invested from the private sector in residential housing and commercial real estate.

"Egypt's risk of balance of payment crisis and sovereign default are huge if it were 'left on its own' without 'artificial short-term external help'," Feriani told CNBC.

Ghana

The lower-middle income country in sub-Saharan Africa sought assistance from the IMF earlier in August, in a dramatic U-turn for the government, who only days before had said it wasn't considering a loan.

The move did not surprise currency traders however, who had watched the Ghanaian cedi tank nearly 60 percent against the U.S. dollar this year—following a 20 percent decline in 2013.

Moody's downgraded Ghana's sovereign rating by one notch from B1 to B2 with a negative outlook in June, citing its high and rising debt burden. It forecast Ghanaian public debt will exceed 65 percent of GDP by end-2015, up from 55.7 percent last year.

One concern is the county's reliance on economic aid from its neighbors in the Gulf—and what could happen if that flow dried up. To date, Saudi Arabia, Kuwait, and the United Arab Emirates have pledged over $18 billion in direct loans, fuel subsidies, and grants to the Egyptian government, with billions more being invested from the private sector in residential housing and commercial real estate.

"Egypt's risk of balance of payment crisis and sovereign default are huge if it were 'left on its own' without 'artificial short-term external help'," Feriani told CNBC.

Ghana

The lower-middle income country in sub-Saharan Africa sought assistance from the IMF earlier in August, in a dramatic U-turn for the government, who only days before had said it wasn't considering a loan.

The move did not surprise currency traders however, who had watched the Ghanaian cedi tank nearly 60 percent against the U.S. dollar this year—following a 20 percent decline in 2013.

Moody's downgraded Ghana's sovereign rating by one notch from B1 to B2 with a negative outlook in June, citing its high and rising debt burden. It forecast Ghanaian public debt will exceed 65 percent of GDP by end-2015, up from 55.7 percent last year.

Exotix Partners Chief Economist Stuart Culverhouse said

the government has been in denial about the severity of Ghana's

financial straits—which include hefty fiscal and current account

deficits, rising inflation and low foreign exchange reserves.

"Rather than tighten fiscal policy in line with available financing, the government seems determined to continue its expansionary stance," Culverhouse said in a fixed income note this month.

Moody's thinks IMF intervention will be a "credit positive" for Ghana, if it leads to a program aimed at stemming the fiscal overruns and inflationary pressure driving the cedi's depreciation. The IMF plans to start discussions about a program in September.

"Rather than tighten fiscal policy in line with available financing, the government seems determined to continue its expansionary stance," Culverhouse said in a fixed income note this month.

Moody's thinks IMF intervention will be a "credit positive" for Ghana, if it leads to a program aimed at stemming the fiscal overruns and inflationary pressure driving the cedi's depreciation. The IMF plans to start discussions about a program in September.

http://www.cnbc.com/id/101953868

Subscribe to:

Posts (Atom)