SHORT TERM / MEDIUM TERM: Technical Analysis - EW

Global markets found a bottom last week, and looks to have a good rally til earliest of Dec 4th week, and longest would be Jan-Feb. But i do suggest this could be only until Dec 4th week to 1st week Jan.

After the said Dec rally, correction of up to 5-10% will be encountered, after that, bull market resumes.

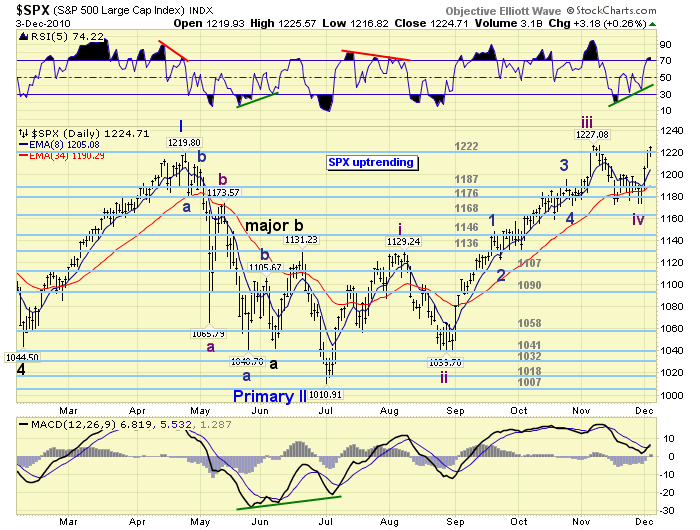

Looking at the Elliot Wave analysis, quoting the blog of Caldaro, "As a result of these fibonacci relationships we are now projecting this uptrend should end within the 1291-1313 pivot range in January 2011."

Fearless forecast and figures:

U.S. hourly charts point to some correction due to its negative divergence, and may correct to less than 3%, overall:

DOW: target rally of up to 11400-12000 before the correction

PSE: yrend, 4300-4450, might visit 4500 when DOW peaks, maybe Dec to early Jan also

Technical Explanation:

We will be ending the Primary Wave 3, Intermediate Wave 1 this Dec-Jan which is making the 5-10% correction as stated above.

No comments:

Post a Comment