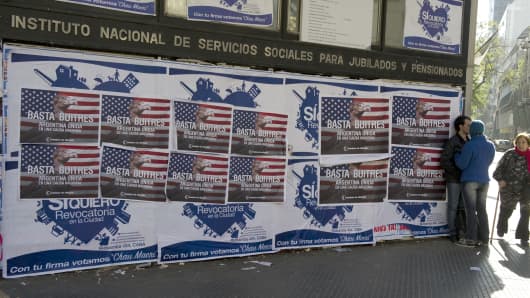

Argentina's lengthy debt saga returned to the spotlight

this week, with its second default in only 12 years triggering George

Soros and other investors to sue Bank of New York Mellon for withholding

interest payments.

This came after Argentina refused to comply with a U.S. legal ruling ordering it to repay $1.3 billion to creditors, triggering a selective default. Moody's Investors Service downgraded its outlook for the country's debt to "negative" at the end of July and confirmed its long-term credit rating at "Caa1"—meaning it views Argentine debt as a highly risky investment at the precarious end of the "junk bond" spectrum.

This came after Argentina refused to comply with a U.S. legal ruling ordering it to repay $1.3 billion to creditors, triggering a selective default. Moody's Investors Service downgraded its outlook for the country's debt to "negative" at the end of July and confirmed its long-term credit rating at "Caa1"—meaning it views Argentine debt as a highly risky investment at the precarious end of the "junk bond" spectrum.

Argentina is, nonetheless, only one of several

countries whose shaky finances leave them on the brink of being unable

to repay their obligations. Moody's currently rates 10 other countries'

debt as equally or even more risky than that of Argentina. These span

the globe, from nearby by Venezuela and Ecuador to Pakistan and Greece.

Read MoreAre risky European bonds in a bubble?

The table below shows the countries around the world judged as most likely to default on their sovereign debt by Moody's. Countries rated Caa1, like Egypt, are judged as risky as Argentina, while those rated Caa2 or Caa3 are even more speculative:

Read MoreAre risky European bonds in a bubble?

The table below shows the countries around the world judged as most likely to default on their sovereign debt by Moody's. Countries rated Caa1, like Egypt, are judged as risky as Argentina, while those rated Caa2 or Caa3 are even more speculative:

Other countries further up the junk bond spectrum still

cause concern, like Ghana, whose credit rating was downgraded in June

and has announced it might tap the International Monetary Fund (IMF) for

a loan as soon as next month.

Ukraine

Ukraine's economic recession has deepened over the past few months, with a sharp fall in industrial production as the conflict with Russia drags on. Macroeconomic research firm Capital Economics forecasts Ukraine's economy contracted by around 5 percent year-on-year in July, following a 4.7 percent year-on-year fall in the second quarter.

"We are only just seeing the economic impact on the conflict in the East in the numbers," Nomura Emerging Market Economist Peter Attard Montalto told CNBC on Wednesday.

"Write-downs and restructurings are possible in Ukraine as the currency slides further, growth continues to surprise to the downside and the overall debt burden continues to climb."

Ukraine

Ukraine's economic recession has deepened over the past few months, with a sharp fall in industrial production as the conflict with Russia drags on. Macroeconomic research firm Capital Economics forecasts Ukraine's economy contracted by around 5 percent year-on-year in July, following a 4.7 percent year-on-year fall in the second quarter.

"We are only just seeing the economic impact on the conflict in the East in the numbers," Nomura Emerging Market Economist Peter Attard Montalto told CNBC on Wednesday.

"Write-downs and restructurings are possible in Ukraine as the currency slides further, growth continues to surprise to the downside and the overall debt burden continues to climb."

Moody's downgraded Ukrainian bonds to Caa3 with negative

outlook in April this year—two notches below Argentina. The agency

cited Ukraine's escalating geopolitical crisis and stressed external

liquidity position, the withdrawal of Russian financial support and a

rise in gas import prices. It sees Ukraine's debt-to-GDP ratio hitting

55-60 percent by the end of the year, up from 40.5 percent at end-2013.

Nonetheless, economists view a formal default as unlikely given the amount of international assistance Ukraine is receiving. The European Union has pledged 11 billion euros ($14.5 billion) to help the country, with another $17 billion coming from the IMF.

"The level of international support is still so great that any (debt) restructuring, if it were ever to occur, is likely to be pushed out as far as possible," said Attard Montalto.

Egypt

Three years after the "Arab Spring" revolution, unsettled political conditions continue to weaken Egypt's economy.

Back in March last year, Moody's downgraded Egypt's sovereign debt to Caa1 with "negative outlook"—exactly the same view it now holds on Argentina. It warned there was a 40 percent possibility of Egypt defaulting within the next five years.

Nonetheless, economists view a formal default as unlikely given the amount of international assistance Ukraine is receiving. The European Union has pledged 11 billion euros ($14.5 billion) to help the country, with another $17 billion coming from the IMF.

"The level of international support is still so great that any (debt) restructuring, if it were ever to occur, is likely to be pushed out as far as possible," said Attard Montalto.

Egypt

Three years after the "Arab Spring" revolution, unsettled political conditions continue to weaken Egypt's economy.

Back in March last year, Moody's downgraded Egypt's sovereign debt to Caa1 with "negative outlook"—exactly the same view it now holds on Argentina. It warned there was a 40 percent possibility of Egypt defaulting within the next five years.

"Egypt's sovereign balance sheet (including low FX

reserves) and external accounts worsened dramatically since the start of

the Arab Spring in early 2011 and are very fragile," Slim Feriani,

executive chairman of Advance Emerging Capital, told CNBC last week.

One concern is the county's reliance on economic aid from its neighbors in the Gulf—and what could happen if that flow dried up. To date, Saudi Arabia, Kuwait, and the United Arab Emirates have pledged over $18 billion in direct loans, fuel subsidies, and grants to the Egyptian government, with billions more being invested from the private sector in residential housing and commercial real estate.

"Egypt's risk of balance of payment crisis and sovereign default are huge if it were 'left on its own' without 'artificial short-term external help'," Feriani told CNBC.

Ghana

The lower-middle income country in sub-Saharan Africa sought assistance from the IMF earlier in August, in a dramatic U-turn for the government, who only days before had said it wasn't considering a loan.

The move did not surprise currency traders however, who had watched the Ghanaian cedi tank nearly 60 percent against the U.S. dollar this year—following a 20 percent decline in 2013.

Moody's downgraded Ghana's sovereign rating by one notch from B1 to B2 with a negative outlook in June, citing its high and rising debt burden. It forecast Ghanaian public debt will exceed 65 percent of GDP by end-2015, up from 55.7 percent last year.

One concern is the county's reliance on economic aid from its neighbors in the Gulf—and what could happen if that flow dried up. To date, Saudi Arabia, Kuwait, and the United Arab Emirates have pledged over $18 billion in direct loans, fuel subsidies, and grants to the Egyptian government, with billions more being invested from the private sector in residential housing and commercial real estate.

"Egypt's risk of balance of payment crisis and sovereign default are huge if it were 'left on its own' without 'artificial short-term external help'," Feriani told CNBC.

Ghana

The lower-middle income country in sub-Saharan Africa sought assistance from the IMF earlier in August, in a dramatic U-turn for the government, who only days before had said it wasn't considering a loan.

The move did not surprise currency traders however, who had watched the Ghanaian cedi tank nearly 60 percent against the U.S. dollar this year—following a 20 percent decline in 2013.

Moody's downgraded Ghana's sovereign rating by one notch from B1 to B2 with a negative outlook in June, citing its high and rising debt burden. It forecast Ghanaian public debt will exceed 65 percent of GDP by end-2015, up from 55.7 percent last year.

Exotix Partners Chief Economist Stuart Culverhouse said

the government has been in denial about the severity of Ghana's

financial straits—which include hefty fiscal and current account

deficits, rising inflation and low foreign exchange reserves.

"Rather than tighten fiscal policy in line with available financing, the government seems determined to continue its expansionary stance," Culverhouse said in a fixed income note this month.

Moody's thinks IMF intervention will be a "credit positive" for Ghana, if it leads to a program aimed at stemming the fiscal overruns and inflationary pressure driving the cedi's depreciation. The IMF plans to start discussions about a program in September.

"Rather than tighten fiscal policy in line with available financing, the government seems determined to continue its expansionary stance," Culverhouse said in a fixed income note this month.

Moody's thinks IMF intervention will be a "credit positive" for Ghana, if it leads to a program aimed at stemming the fiscal overruns and inflationary pressure driving the cedi's depreciation. The IMF plans to start discussions about a program in September.

http://www.cnbc.com/id/101953868

No comments:

Post a Comment